Explore BayCoast Mortgage’s Comprehensive Product Line. Contact us today to take the first step toward homeownership! Call 877-466-2678 or email applynow@baycoastbank.com. [ read more... ]

May 6, 2024 Partners Meeting

Partners meeting held on May 26, 2024 at 23 Elm Street in New Bedford. [ read more... ]

Bank 5 Family of Home Loans

Unlock the Perfect Home Loan. [ read more... ]

The first home is one to remember.

Freddie Mac’s HomeOne Loan and Fannie Mae’s First-time Homebuyer Program* lets you buy a house with just 3% down. With less restrictive underwriting criteria and lower interest rates, eligibility has never been easier to help individuals finance their first homes. [ read more... ]

Dedicated to helping you make homeownership a reality.

At Webster Bank, we believe that everyone deserves a place to call home. That’s why we’re introducing Webster’s You’re Home Program — giving more families the chance to say “we’re home” with additional financing solutions and dedicated community lending experts to support you on your homeownership journey. [ read more... ]

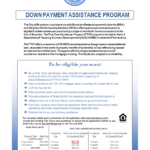

Down Payment Assistance Program

Download Printable Flyer

Download Printable Flyer [ read more... ]

Why finance a home with MassHousing?

Get printable flyer!

Get printable flyer! [ read more... ]

Affordable Housing

Access to decent, affordable housing provides stability for vulnerable families and helps prevent homelessness. [ read more... ]

buyfallrivernow

Contact John P. Francoeur, Housing Director Fall River Community Development Agency City of Fall River | Phone/Voice/TDD: 508.679.0131 | Email: jfrancoeur@fallriverma.gov [ read more... ]

HUD’s “Block Party” Homebuyer Event

HUD’s “Block Party” Homebuyer Event hosted by the City of New Bedford on September 25, 2023 was a great success. Over 120 first time homebuyers attended, and were able to learn about programs offered by MassHousing, Local Lenders, City and Non-profits. Great example of education and collaboration. [ read more... ]